SUTA taxes are state unemployment taxes that employers pay at the state level to fund state unemployment insurance programs.

Most small business owners start their own companies with a passion for a product or service. But most don’t get excited about processing payroll . Businesses have multiple tax obligations and acronyms to keep track of, including SUTA and FUTA taxes.

SUTA is the State Unemployment Tax Act, which requires employers to pay unemployment taxes into their respective state’s unemployment program. FUTA is for the Federal Unemployment Tax Act that requires payments into the federal uninsurance program.

In most states, SUTA and FUTA do not show up on your employee’s pay stub because you (the employer) pay the full amount. Let’s look at exactly how SUTA taxes work, how to figure out your rate, and how to calculate them:

SUTA is a payroll tax employers pay to the state. Money from SUTA taxes goes into a state unemployment fund on behalf of that state’s employees. The fund pays unemployment insurance to employees who become unemployed through no fault of their own, such as through company layoffs.

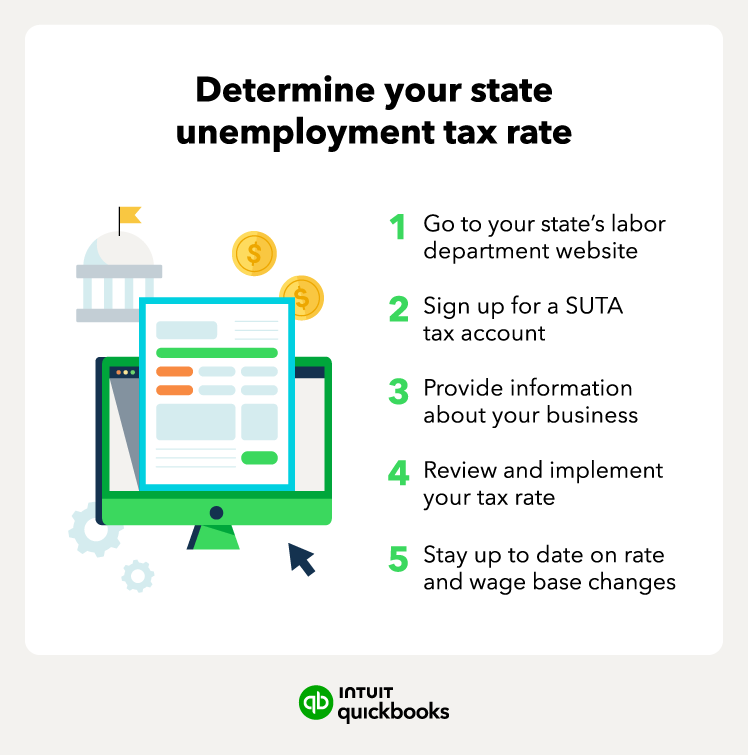

When you hear of someone collecting unemployment, they are likely drawing from SUTA funds. The SUTA tax rate companies pay varies depending on the state in which they do business. Your state’s labor department will provide guidelines for paying SUTA taxes.

While all employers must pay the SUTA tax, the exact amount each company must pay varies. Currently, two factors determine your SUTA tax: your company’s taxable wage base and SUTA tax rates.

To calculate your SUTA tax, you’ll need to know how much of each employee’s wages are subject to the SUTA tax. Known as the taxable wage base, this is the maximum amount of earnings you can tax in a calendar year for an individual worker.

Each state sets its taxable wage base. For example, California has a taxable wage base of $7,000, while Colorado has a base of $20,400 for 2024.

Next, you’ll need to know your state’s SUTA tax rate. Each state has a range of minimum and maximum tax rates for state unemployment taxes. For example, California’s SUTA tax rate range for 2024 is 1.5% to 6.2%, while Colorado’s range is 0.75% to 10.39%.

The tax rate for your company will be within your state’s range but depends on an assessment of your company. Your experience rating is part of that assessment. The number of former employees who file for state unemployment benefits affects your experience rating.

For instance, if a company has a large number of workers who file for unemployment in a given year, you may have a higher tax rate. As a result, businesses with the highest employee turnover rates often pay higher unemployment tax rates.

FYI: Companies often receive a FUTA tax credit for the unemployment contributions they pay to the state where they do business.

Properly calculating and paying SUTA taxes is crucial, as it also impacts the amount of FUTA tax a business must submit. Each business receives a credit toward FUTA taxes based on SUTA tax payments.

In general, employers must pay 6% of gross wages, up to a cap of $7,000 per worker, to fund FUTA for each employee. In all 50 states, employers pay the same 6% rate for every worker, but the federal government may change the rate in future years.

Note that SUTA and FUTA taxes are also known as unemployment taxes. Meanwhile, FICA taxes make up Social Security and Medicare taxes.

If you file and pay your SUTA taxes on time with the state, you may be eligible for a tax credit when it comes time to file your annual FUTA taxes. You can report the SUTA tax you pay using Form 940 to get the tax credit—as long as your business is not located in a credit reduction state.

A credit reduction state owes money to the federal government’s unemployment fund to pay their workers’ unemployment insurance. You can check the Department of Labor’s updated list of credit reduction states .

FUTA offers a maximum 5.4% tax credit to companies that pay their state unemployment contributions on time. When you subtract that 5.4% FUTA credit from the standard 6% rate, this greatly reduces the amount of FUTA tax your company owes to a much lower 0.6%.

Say you run a small marketing agency in Texas with six employees.

For 2024, Texas’ taxable wage base for employees is $9,000, and the tax rates range from 0.25% to 6.25%.

Assume that your company’s SUTA tax rate for 2024 is 2.7%. Using the formula below, you would need to pay $1,458 into your state’s unemployment fund:

($9,000 taxable wage base x 2.7% tax rate) x 6 employees = $1,458 SUTA taxes

Given that you must pay FUTA tax only on the first $7,000 of each employee’s wages, your total wage base is $7,000 for each of your six employees, or $42,000. Your FUTA tax liability is $2,520 ($42,000 x 6%).

Recall that you can get a 5.4% FUTA tax credit for paying your SUTA taxes on time. Your FUTA tax rate is 0.6%. So, in the case of our Texas agency, you’d have a much lower FUTA tax liability of $252 ($42,000 x 0.6%) after the tax credit.

Your company may not be eligible for the FUTA tax credit if you don’t file and pay its SUTA taxes on time. Here are some tips to keep your SUTA tax rate as low as possible:

Good HR practices allow you to lay out expectations of employees, as well as keep track of potential issues with employees. If an employee files a wrongful unemployment claim, use your documentation to improve the chances of getting the claim denied and thereby avoid paying out unemployment insurance.

Unemployment taxes like SUTA taxes are an important component of payroll taxes . While payroll is notoriously complicated, you can easily navigate the various tax dates, rates, and payments with a good system in place.

Luckily, there are payroll software programs available, like QuickBooks Payroll, that offer a full suite of payroll tools for businesses of any size. With software to simplify your SUTA and FUTA calculations, you can get back to doing what you do best—running and growing your business.

Pay your team and manage benefits with the #1 payroll service provider.Yes, all states require SUTA tax payments. However, the tax rate varies by state. SUTA taxes are employer-paid for all 50 states, but three states—Alaska, New Jersey, and Pennsylvania—also require employees to pay state unemployment taxes.

Is the FUTA rate higher than SUTA?The FUTA tax rate is 6.0%, which is generally higher than the SUTA tax rate for many companies. However, companies may have a higher SUTA tax rate depending on their state. For example, the maximum SUTA rate for many states is above 6.0%.

Are SUTA and FUTA deductible?Yes, you can deduct the employer-paid portion of SUTA and FUTA taxes. However, SUTA withholding from employee pay is not deductible.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

Recommended for you

When are taxes due? Tax dates for 2024

February 23, 2024

What is FUTA? Basics, examples, and how to calculate

1099-MISC vs. 1099-NEC: Differences and filing deadlines

October 27, 2023

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.